UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant |

Filed by a Party other than the Registrant |

Check the appropriate box: |

National Bank Holdings |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

|

|

|

|

7800 East Orchard Road, Suite 300

Greenwood Village, CO 80111

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To the Shareholders of National Bank Holdings Corporation:

We cordially invite you to attend the Annual Meeting of Shareholders of National Bank Holdings Corporation at 8:30 a.m. Mountain Time on Wednesday, May 2, 2018, at the DoubleTree by Hilton Denver Tech Center, located at 7801 East Orchard Road, Greenwood Village, Colorado 80111. The purpose of the meeting is to:

Notice of 2024 Annual Meeting of Shareholders |

| DEAR SHAREHOLDERS:I’m pleased to invite you to the Annual Meeting of Shareholders of National Bank Holdings Corporation. At the meeting, shareholders will vote on the following proposals: |

|

|

|

|

|

|

|

Information with respect to these matters is contained in the proxy statement accompanying this notice.

The proxy statement and the accompanying form of proxy are first being sent to shareholders on or about March 29, 2024.

YOUR VOTE IS IMPORTANT: Whether or not you plan to attend the meeting, we urge you to vote and submit your proxy so that as many shares as possible may be represented during the meeting. We appreciate your cooperation in returning your proxy promptly.

Please call us at 720-554-6640 if you need instructions on how to attend the meeting or have questions about how to vote.

A proxy for use at the meeting in the form accompanying this notice is hereby solicited on behalf of the Board of Directors from holders of Class A common stock. The Board of Directors has fixed March 12, 2018 as the record date for determining which shareholders have the right to receive notice of, and to vote at, the meeting or any postponements or adjournments thereof.

The proxy statement and the accompanying form of proxy are first being sent to shareholders on or about March 26, 2018.

Whether or not you plan to attend the meeting, we urge you to vote and submit your proxy so that as many shares as possible may be represented at the meeting. Your vote is important and we appreciate your cooperation in returning your proxy promptly. Your proxy is revocable and will not affect your right to vote in person at the meeting.

Please call us at 720-529-3346 if you need directions to attend the meeting or have questions about how to vote in person.

By Order of the Board of Directors, | ||||

/s/ Angela Petrucci Angela Petrucci, Secretary |

| | Meeting Information | |

|

| Date: | Wednesday, May 1, 2024 | |

Greenwood Village, Colorado

March 19, 2018

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to Be Held on May 2, 2018: Our Proxy Statement and 2017 Annual Report to Shareholders are also available at www.proxyvote.com.

NATIONAL BANK HOLDINGS CORPORATION

PROXY STATEMENT

2018 ANNUAL MEETING OF SHAREHOLDERS

| | Time: | 8:30 a.m. Mountain Time | |

|

| Location: | Community Banks Mortgage a division of NBH Bank 7800 E. Orchard Road, Suite 100 Greenwood Village, CO 80111 | |

| | | ||

| How to Vote and Other Details | |||

| | | | |

| |

Record | March 11, 2024 is the record date for determining which shareholders have the right to receive notice of, and to vote at, the meeting or any postponements or adjournments thereof. | |

| | Registered and beneficial shareholders can vote their shares in the following ways: | ||

| |

Internet | Log on to www.proxyvote.com and enter the 16- digit control number provided on your proxy card | |

| |

Telephone | Dial 1-800-690-6903 and enter the 16-digit control number provided on your proxy card | |

| |

| Mark, sign and date your proxy card and return it in the postage paid envelope we have provided or return it to Vote Processing c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717 | |

| |

| If you are a “record” shareholder of Class A common stock (that is, you hold Class A common stock in your own name in NBHC’s stock records maintained by our transfer agent), register upon your arrival at the Meeting, request a ballot and submit the ballot with your voting instructions at the Meeting. | |

Table of Contents

General Information

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board of Directors” or the “Board”) of National Bank Holdings Corporation, a Delaware corporation (the “Company”, “NBHC”, “we”, “us” or “our”), to be used atduring our 20182024 Annual Meeting of Shareholders (the “Meeting”) and at any postponements or adjournments thereof. The Meeting will be held at the DoubleTree by Hilton Denver Tech Center,offices of Community Banks Mortgage, a division of NBH Bank located at 7801 East7800 E. Orchard Road, Suite 100, Greenwood Village, Colorado 80111 at 8:30 a.m. Mountain Time on Wednesday, May 2, 2018.1, 2024.

In this proxy statement, we refer to our employees as “associates.” In this proxy statement, we also refer to the Notice of Annual Meeting of Shareholders, this proxy statement, our 20172023 Annual Report to Shareholders and the accompanying proxy as our “Proxy Materials.”

Holders of record of shares of Class A common stock at the close of business on March 12, 201811, 2024 (the record date) are entitled to notice of, and to vote at, the Meeting. As of such date, there were 30,394,33637,806,167 shares of Class A common stock outstanding and entitled to vote. In addition, as of such date, there were 226,363237,662 shares of unvested restricted stock (Class A common stock) entitled to vote. Each share of our Class A common stock is entitled to one vote on all matters (in the case of Proposal 1, with respect to the election of each director).

Please read the Proxy Materials carefully. You should consider the information contained in this proxy statement when deciding how to vote your shares. You have a choice of voting by proxy over the Internet, by using a toll-free telephone number or by completing a proxy card and mailing it in the postage-paid envelope provided. If your shares are held in the name of a bank, broker or other holder of record, please refer to your proxy card or the voting information provided by your bank, broker or other holder of record to see which voting options are available to you. Voting onvia the Internet, by telephone or by mail will not prevent you from attending or voting your shares atduring the Meeting. However, if you hold shares through a bank, broker or other holder of record, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote atduring the Meeting. Otherwise, your shares will be voted in the manner in which you instructed the record holder of your shares.

When you vote by proxy, your shares will be voted according to your instructions. If you are a shareholder of record, you may revoke your proxy at any time prior to the close of the polls atduring the Meeting by submitting a later dated proxy or delivering a written notice of revocation to our Secretary, Zsolt K. Besskó,Angela Petrucci, at National Bank Holdings Corporation, 7800 E. Orchard Road, Suite 300, Greenwood Village, CO 80111. If you hold shares through a bank, broker or other holder of record, you must contact the holder of record to revoke any prior voting instructions.

We pay the cost of soliciting proxies. Members of our Board and other associates may solicit proxies by mail, telephone, fax, email or in person.electronically. We will not pay directors or other associates any extra amounts for soliciting proxies. We may, upon request, reimburse brokerage firms, banks or similar nominees representing street name holders for their expenses in forwarding Proxy Materials to their customers who are street name holders and obtaining their voting instructions.

Any shareholder entitled to vote at the Meeting may attend the Meeting. If you hold shares through a bank, broker or other holder of record and would like to attend the Meeting, you will need to bring an account statement or other acceptable evidence of ownership of our Class A common stock as of the record date. Each shareholder who attends may be asked to present valid picture identification, such as a driver’s license or passport. Please note that the use of cell phones, tablets, recording and photographic equipment, computers and/or other similar devices is not permitted in the meeting room at the Meeting.

Our principal executive offices are located at 7800 E. Orchard Road, Suite 300, Greenwood Village, CO 80111.

Vote Required for Approval

The presence, by proxy or in person,at the meeting, of the holders of a majority of the outstanding shares of our Class A common stock entitled to vote atduring the Meeting shall constitute a quorum. Withheld votes, abstentions and broker “non-votes” (shares held by a broker or nominee that has not received voting instructions from its client and does not have discretionary authority to vote on a particular matter) are counted as present for purposes of establishing a quorum. If you are a beneficial shareholder and your broker holds your shares in its name, the rules of the New York Stock Exchange (“NYSE”) permit your broker to vote your shares on the ratification of the appointment of our independent registered certified public accounting firm (Proposal 2), even if the broker does not receive voting instructions from you. However, under the NYSE rules, your broker cannot vote your shares on the other proposals if you do not timely provide instructions for voting your shares.

For Proposal 1 (election of directors), the sevennine nominees for director receiving a plurality of the votes cast atduring the Meeting in person or by proxy will be elected. This means that the director nominee with the most votes for a particular slot is elected for that slot. Only votes “for” affect the outcome. BrokerWithheld votes and broker “non-votes” will have no effect on the voting results for this proposal.

Proposal 2 (ratification of the appointment of our independent registered certified public accounting firm) will be passed if a majority of the shares of our Class A common stock present atduring the Meeting and entitled to vote cast their votes “for” this proposal. Abstentions will be counted as votes present and entitled to vote and will have the same effect as votes “against” this proposal. No broker “non-votes” are expected to exist in connection with this proposal.

Proposal 3 (the advisory proposal on the compensation of our named executive officers) will be approved if a majority of the shares of our Class A common stock present atduring the Meeting and entitled to vote cast their votes “for” this proposal. Abstentions will be counted as votes present and entitled to vote and will have the same effect as votes “against” this proposal. Broker “non-votes” are not considered to be entitled to vote and therefore will have no effect on the voting results for this proposal. The advisory vote on executive compensation (Proposal 3) is non-binding, as provided by law.non-binding. Our Board and our Compensation Committee, however, will review the results of the vote and, consistent with our commitment to shareholder engagement, will take it into account in making a determination concerning the advisory vote on executive compensation.

Approval of any other business that may properly come before the Meeting will require the affirmative vote of a majority of the shares present in person or represented by proxy atduring the Meeting and entitled to vote thereon.

VOTING FOR REGISTERED AND BENEFICIAL SHAREHOLDERS

Voting for Registered and beneficial shareholders canBeneficial Shareholders

You may vote theiryour shares induring the following ways:Annual Meeting or by proxy. There are three ways to vote by proxy:

ByVia Internet: You may vote your shares over the internet by going to www.proxyvote.com. You will need to enter your 16-digit control number (found at the top right hand side of the form of proxy or voting instruction form that you received in the mail) to identify yourself as a shareholder on the voting website.

By Telephone: Vote by telephone by calling 1-800-690-6903. You will need to enter your 16-digit control number (found at the top right hand side of the form of proxy or voting instruction form that you received in the mail) to identify yourself as a shareholder.

By Mail: Mark, sign and date your proxy card and return it in the postage paid envelope we have provided or return it to Vote Processing c/o Broadridge, 51 Mercedes Way, Edgewood, NY, 11717.

In Person: If you are a “record” shareholder of Class A common stock (that is, you hold Class A common stock in your own name in NBHC’s stock records maintained by our transfer agent), register upon your arrival at the Meeting, request a ballot and submit the ballot with your voting instructions at the Meeting.

Beneficial shareholders who wish to vote at the Meeting will need to obtain a proxy form from the institution that holds your shares and follow the voting instructions on such form.

2

Your voting instructions must be received by the proxy voting deadline which is Tuesday, May 1, 2018.April 30, 2024. The internet (other than during the meeting) and telephone voting facilities will close at 11:59 p.m. Eastern timeTime on May 1, 2018. April 30, 2024.

Even if you plan to attend the Annual Meeting, we encourage you to vote your shares by proxy using one of the methods described above. Shareholders of record who attend the meeting may vote their shares online, even though they have sent in proxies.

If you have any questions or require voting assistance, please contact us at IR@nationalbankholdings.com.

Stock Ownership of Certain Beneficial Owners and Management

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 12, 2018,11, 2024, information regarding the beneficial ownership of our Class A common stock by (i) each of our Chief Executive Officer (“CEO”), Chief Financial Officer and the three other highest paid executive officers for 2017 (those five executive officers are listed in the table captioned “Summary Compensation Table” elsewhere in this proxy statement and are collectively referred to as the “Named Executive Officers” or “NEOs”); (ii) each director; (iii) all current directors and executive officers as a group and (iv) each person known by us to own beneficially more than five percent of the shares of our Class A common stock (our only class of voting securities outstanding).; (ii) each of our Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”) and the three other highest paid executive officers for 2023 (those five executive officers are listed in the table captioned “Summary Compensation Table” elsewhere in this proxy statement and are collectively referred to as the “Named Executive Officers” or “NEOs”); (iii) each director; and (iv) all current directors and executive officers as a group.

We have determined beneficial ownership in accordance with the rules of the Securities and Exchange Commission (“SEC”). Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons and entities named in the tables below have sole voting and investment power with respect to all shares of common stock that they beneficially own, subject to applicable community property laws. We have based our calculation of the percentage of beneficial ownership on 30,620,69938,043,829 shares, which number is comprised of 30,394,33637,806,167 shares of Class A common stock outstanding and 226,363237,662 shares of unvested restricted stock (which shares of restricted stock are entitled to voting rights), in each case as of March 12, 2018.11, 2024.

In computing the number of shares of Class A common stock beneficially owned by a person and the percentage ownership of that person, we deemed outstanding shares of Class A common stock subject to options held by that person that are currently exercisable or exercisable within sixty days of March 12, 2018. 11, 2024.

We, however, did not deem these shares outstanding for the purpose of computing the percentage ownership of any other person. Beneficial ownership representing less than 1% is denoted with an asterisk (*).

| | | | |

| | Amount and nature of | | Percent of |

Name of beneficial owner |

| beneficial ownership |

| class |

5% Shareholders | | | | |

BlackRock, Inc.(1) | | 5,421,736 |

| 14.3% |

The Vanguard Group(2) | | 4,220,345 |

| 11.1% |

Wellington Management Group LLP(3) | | 3,847,909 | | 10.1% |

T. Rowe Price Investment Management, Inc.(4) | | 3,036,217 |

| 8.0% |

Named Executive Officers and Directors | | | | |

G. Timothy Laney(5) |

| 548,701 |

| 1.4% |

Aldis Birkans(6) | | 90,542 | | * |

Richard U. Newfield, Jr.(7) |

| 193,734 |

| * |

Angela N. Petrucci(8) | | 39,622 | | * |

Christopher S. Randall(9) | | 38,650 | | * |

Ralph W. Clermont(10) |

| 89,162 |

| * |

Robert E. Dean(11) |

| 32,020 |

| * |

Robin Doyle(12) | | 0 | | * |

Alka Gupta(13) | | 6,885 | | * |

Fred J. Joseph(14) |

| 21,329 |

| * |

Patrick G. Sobers(15) | | 36,582 | | * |

Micho F. Spring(16) |

| 38,256 |

| * |

Art Zeile(17) |

| 17,378 |

| * |

All current executive officers and directors as a group (15 persons) |

| 1,255,413 |

| 3.3% |

3

|

|

|

|

|

|

| Amount and nature of |

| Percent of |

Name of beneficial owner |

| beneficial ownership |

| class |

Named Executive Officers and Directors |

|

|

|

|

G. Timothy Laney(1) |

| 1,109,798 |

| 3.5% |

Brian F. Lilly(2) |

| 157,312 |

| * |

Zsolt K. Besskó(3) |

| 63,627 |

| * |

Richard U. Newfield, Jr.(4) |

| 366,928 |

| 1.2% |

Patrick G. Sobers(5) |

| 20,806 |

| * |

Ralph W. Clermont(6) |

| 81,936 |

| * |

Robert E. Dean(7) |

| 56,299 |

| * |

Fred J. Joseph(8) |

| 9,396 |

| * |

Micho F. Spring(9) |

| 66,026 |

| * |

Burney S. Warren, III(10) |

| 58,959 |

| * |

Art Zeile(11) |

| 4,230 |

| * |

All current executive officers and directors as a group (14 persons) |

| 2,031,252 |

| 6.4% |

5% Shareholders |

|

|

|

|

BlackRock, Inc.(12) |

| 3,436,780 |

| 11.2% |

T. Rowe Price Associates, Inc.(13) |

| 3,119,024 |

| 10.2% |

The Vanguard Group(14) |

| 2,336,881 |

| 7.6% |

Dimensional Fund Advisors LP (15) |

| 2,252,715 |

| 7.4% |

| (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

| As reported on Schedule 13G filed with the SEC on January |

| (2) | As reported on Schedule 13G filed with the SEC on February 13, 2024 by The Vanguard Group (“Vanguard”). Vanguard reported sole voting power with respect to zero shares, sole dispositive power with respect to 4,164,151 shares, shared voting power with respect to 23,715 shares, and shared dispositive power with respect to 56,194 shares. |

| (3) | As reported on Schedule 13G filed with the SEC on February 8, 2024 jointly by Wellington Management Group LLP (“Wellington Management”), Wellington Group Holdings LLP (“Wellington Group”), Wellington Investment Advisors Holdings LLP (“Wellington Advisors”), and Wellington Management Company LLP (“Wellington Company”). Wellington Management, Wellington Group, and Wellington Advisors each reported sole voting power with respect to zero shares, sole dispositive power with respect to zero shares, shared voting power with respect to 2,915,315 shares, and shared dispositive power with respect to all shares beneficially owned. Wellington Company reported sole voting power with respect to zero shares, sole dispositive power with respect to zero shares, shared voting power with respect to 2,894,501 shares, and shared dispositive power with respect to all shares beneficially owned. Wellington Management reported that all shares beneficially owned are owned of record by clients of one or more investment advisers directly or indirectly owned by Wellington Management; accordingly, those clients |

| |

4 |

|

| have the right to receive, or the power to direct the receipt of, dividends from, or the proceeds from the sale of, such securities. |

| (4) | As reported on Schedule 13G filed with the SEC on February 14, |

| (5) |

|

|

|

|

| (6) | Includes 7,455 unvested restricted shares for which Mr. Birkans has voting power and 45,650 shares issuable upon the exercise of options. |

| (7) | Includes 5,929 unvested restricted shares for which Mr. Newfield has voting power and 50,254 shares issuable upon the exercise of options. |

| (8) | Includes 3,512 unvested restricted shares for which Ms. Petrucci has voting power and 13,301 shares issuable upon the exercise of options. |

| (9) | Includes 3,404 unvested restricted shares for which Mr. Randall has voting power and 20,738 shares issuable upon the exercise of options. |

| (10) | Includes 2,510 unvested restricted shares for which Mr. Clermont has voting power. Also includes 79,939 shares owned by the Ralph W. Clermont Irrevocable Trust. |

| (11) | Includes 2,151 unvested restricted shares for which Mr. Dean has voting power. |

| (12) | Ms. Doyle was appointed to the Board on March 18, 2024. |

| (13) | Includes 2,151 unvested restricted shares for which Ms. Gupta has voting power. |

| (14) | Includes 2,151 unvested restricted shares for which Mr. Joseph has voting power. |

| (15) | Includes 2,151 unvested restricted shares for which Mr. Sobers has voting power and 15,876 shares issuable upon the exercise of options. |

| (16) | Includes 2,151 unvested restricted shares for which Ms. Spring has voting power. |

| (17) | Includes 2,151 unvested restricted shares for which Mr. Zeile has voting power. |

| |

2024 Annual Proxy Statement | 5 |

PROPOSALProposal 1 - ELECTION OF DIRECTORSElection of Directors

Size and Composition of Board. We have setThe Board currently stands at nine members with the sizeappointment of the Board at seven members.Robin Doyle as of March 18, 2024. The current members of the Board are G. Timothy Laney (Chairman), Ralph W. Clermont (independent Lead Director), Robert E. Dean, Robin Doyle, Alka Gupta, Fred J. Joseph, Patrick Sobers, Micho F. Spring, Burney S. Warren, III and Art Zeile.

Nominees. Upon the recommendation of the Nominating and& Governance Committee, the Board has nominated the persons named below for reelection to the Board. With the exception of Mr. Laney, who serves as our Chairman, President and CEO, and Mr. Sobers, who retired as an executive officer of the bank in June 2021, the Board has determined that each of these nominees is an independent director, as discussed further below under “Director Independence.”

Each of the directors elected atduring the Meeting will be elected for a one-year term which expires at the next annual meeting of shareholders, and will serve until the director’s successor has been elected and qualified, or until the director’s earlier resignation or removal.

The Board recommends you vote FOR each of the nominees set forth below.

In the event that any nominee is no longer a candidate for director at the time of the Meeting, the proxyholders will vote for the rest of the nominees and may vote for a substitute nominee in their discretion. To the best of its knowledge, the Company has no reason to believe that any of the nominees will be unable to serve as directors if elected.

Ralph W. Clermont, Age 70

Mr. Clermont has served as a director for the Company since 2009 and as the Board’s independent Lead Director since May 2014. He also serves as Chair of the Board’s Audit & Risk Committee and as a member of NBH Bank’s board of directors. Mr. Clermont retired in 2008 as Managing Partner of the St. Louis office of KPMG LLP, and was formerly the partner in charge of KPMG’s Midwest financial services practice. Mr. Clermont joined the St. Louis office of KPMG in 1969 and was elected to partnership in 1977. Mr. Clermont spent over 39 years providing services to the banking industry and has had responsibility for the audits of numerous banking organizations. Subsequent to retiring,

|

The Board recommends you vote “FOR” each of the nominees set forth below. |

5

| |

6 | National Bank Holdings Corporation |

| | |

Age: 76 | Ralph W. Clermont Independent Lead Director Audit & Risk Committee Chair Nominating & Governance Committee Member Compensation Committee Member EXPERIENCE AND QUALIFICATIONS Mr. Clermont has served as a director for the Company since 2009 and as the Board’s independent Lead Director since 2014. As the independent Lead Director, Mr. Clermont is an ex officio member of all of our Board committees with full voting rights. He also serves as Chair of the Board’s Audit & Risk Committee and as a board member of both NBH Bank and Bank of Jackson Hole Trust. He is also a member of the Trust Committee of Bank of Jackson Hole Trust. In October 2015, Mr. Clermont was appointed to the board of directors of Cass Information Systems, Inc., (NASDAQ: CASS), where he also serves on the audit committee and the governance committee. He also serves as a director on the board of Cass Commercial Bank. Mr. Clermont is a certified public accountant and a member of the American Institute of Certified Public Accountants and Missouri Society of Certified Public Accountants. Mr. Clermont retired in 2008 as Managing Partner of the St. Louis office of KPMG LLP, and was formerly the partner in charge of KPMG’s Midwest financial services practice. Mr. Clermont joined the St. Louis office of KPMG in 1969 and was elected to the partnership in 1977. Mr. Clermont was a member of the KPMG’s Assurance Services Committee and was chairman of KPMG’s Quality Improvement Audit Subcommittee. Mr. Clermont spent over 39 years providing services to the banking industry and has had responsibility for the audits of numerous banking organizations. Subsequent to retiring, Mr. Clermont has served as a consultant to various banking institutions on strategic planning, risk management and corporate governance matters. Mr. Clermont received a Bachelor of Science degree in accounting from Saint Louis University. Mr. Clermont’s qualifications to serve on our Board of Directors include his expertise in financial and accounting matters for complex financial organizations. |

Mr. Clermont has served as a consultant to various banking institutions on strategic planning, risk management and corporate governance matters. In October 2015, Mr. Clermont was appointed to the Board of Directors of Cass Information Systems, Inc., where he also serves on the Audit Committee and the Governance Committee. Mr. Clermont is a certified public accountant and a member of the American Institute of Certified Public Accountants and Missouri Society of Certified Public Accountants. Mr. Clermont was a member of the KPMG’s Assurance Services Committee and was chairman of KPMG’s Quality Improvement Audit Subcommittee. Mr. Clermont received a Bachelor of Science degree in accounting from Saint Louis University. Mr. Clermont’s qualifications to serve on our Board of Directors include his expertise in financial and accounting matters for complex financial organizations. As the independent Lead Director, Mr. Clermont is an ex officio member of all of our Board committees with full voting rights.

Robert E. Dean, Age 66

Mr. Dean has served as a director for the Company since 2009 and also serves as Chairman of the Nominating and Governance Committee. Mr. Dean is a private investor. From 2000 to 2003, Mr. Dean was with Ernst & Young Corporate Finance LLC, a wholly owned broker-dealer subsidiary of Ernst & Young LLP, serving as a Senior Managing Director and member of the Board of Managers from 2001 to 2003. From 1976 to 2000, Mr. Dean practiced corporate, banking and securities law with Gibson, Dunn & Crutcher LLP. Mr. Dean co-chaired the firm’s banking practice and advised bank clients on numerous capital markets and merger and acquisition transactions (including FDIC-assisted transactions). Mr. Dean was Partner-in-Charge of the Orange County, California office from 1993 to 1996 and was a member of the law firm’s Executive Committee from 1996 to 1999. Mr. Dean holds a Bachelor of Arts degree from the University of California at Irvine and a Juris Doctor degree from the University of Minnesota Law School. Since November 2014, Mr. Dean has served as a member of the boards of directors of two related Cornerstone closed-end mutual funds (Strategic Value (CLM) and Total Return (CRF)) and as a member of each audit and nominating and governance committee thereof. Mr. Dean’s substantial experience in bank capital markets and merger and acquisition transactions, bank regulatory matters and public company corporate governance matters qualifies him to serve on our Board of Directors.

Fred J. Joseph, Age 65

Mr. Joseph has served as a director of the Company since 2014 and also serves as a member of NBH Bank’s board of directors. Mr. Joseph was a financial services regulator for 30 years, retiring at the end of 2013 as the Banking and Securities Commissioner for the State of Colorado, a dual role created in 2011. He was originally appointed as the Securities Commissioner in 1999. In that role, he oversaw the regulatory agency that licenses stockbrokers, brokerage firms and investment advisers in Colorado. In his role as the Banking Commissioner, he had regulatory oversight of state-chartered commercial banks, money transmitters and trust companies in Colorado. Mr. Joseph also served as the Acting Banking Commissioner for the State of Colorado from 2008 to 2010. From 1992 to 1999, he was the Deputy Securities Commissioner for the State of Colorado. In that position, he oversaw the examination functions as well as the administrative matters for the Colorado Division of Securities. Prior to that, he was the Deputy Commissioner of Financial Services in Colorado for eight years, where he was responsible for the examination and regulatory oversight of state-chartered savings and loan associations and credit unions in Colorado. Mr. Joseph is a past President of the North American Securities Administrators Association (“NASAA”), and also served as a director on NASAA’s Board for almost a decade. Mr. Joseph currently serves as a board member of the Colorado Board of Mortgage Loan Originators, being appointed to that position by the Colorado Governor in 2014. He also serves as a member of the Investor Issues Committee for the Financial Industry Regulatory Authority (FINRA). Mr. Joseph holds a Bachelor of Science degree in Business Administration from Colorado State University-Pueblo and an MBA in Finance and Accounting from Regis University in Denver. Mr. Joseph’s substantial experience in the regulatory fields of financial services and securities qualifies him to serve on our Board of Directors.

6

| |

2024 Annual Proxy Statement | 7 |

| | |

Age: 72 | Robert E. Dean Independent Director Nominating & Governance Committee Chair Audit & Risk Committee Member Compensation Committee Member EXPERIENCE AND QUALIFICATIONS Mr. Dean has served as a director for the Company since 2009 and also serves as Chairman of the Nominating & Governance Committee. Mr. Dean is a private investor. He serves as President and director of his condominium owners association. Since November 2014, Mr. Dean has also served as a member of the boards of directors of two related Cornerstone closed-end mutual funds (Strategic Value (CLM) and Total Return (CRF)) and as a member of each audit and nominating and governance committee thereof. From 2000 to 2003, Mr. Dean was with Ernst & Young Corporate Finance LLC, a wholly owned broker-dealer subsidiary of Ernst & Young LLP, serving as a Senior Managing Director and member of the board of managers from 2001 to 2003. From 1976 to 2000, Mr. Dean practiced corporate, banking and securities law with Gibson, Dunn & Crutcher LLP. Mr. Dean co-chaired the firm’s banking practice and advised bank clients on numerous capital markets and merger and acquisition transactions (including FDIC-assisted transactions). Mr. Dean was Partner-in-Charge of the Orange County, California office from 1993 to 1996 and was a member of the law firm’s executive committee from 1996 to 1999. Mr. Dean holds a Bachelor of Arts degree from the University of California at Irvine and a Juris Doctor degree from the University of Minnesota Law School. Mr. Dean’s substantial experience in bank capital markets and merger and acquisition transactions, bank regulatory matters and public company corporate governance matters qualifies him to serve on our Board of Directors. |

G. Timothy Laney, Age 57

Mr. Laney has served as the Company’s President and Chief Executive Officer and as a director for the Company since 2010 and currently holds the same positions at NBH Bank. Mr. Laney was appointed as Chairman of the Company’s Board of Directors in 2014 and he also serves as the chairman of NBH Bank’s board of directors. Mr. Laney is the former Senior Executive Vice President and Head of Business Services at Regions Financial, one of the nation’s largest full-service banks. He joined Regions Financial in late 2007 to lead the transformation of the bank’s wholesale lines of business. Prior to his tenure at Regions Financial, Mr. Laney had a 24-year tenure with Bank of America, where he held senior management roles in small business, commercial banking, private banking, corporate marketing and change management. He also served as President of Bank of America, Florida, with more than 800 banking centers and $50 billion in total assets. He was also a member of Bank of America’s Management Operating Committee. Mr. Laney is active in community service and currently serves as a board member for the Colorado State Banking Board, the Colorado Bankers Association and Moffitt Cancer Center. Mr. Laney brings to our Board of Directors valuable and extensive experience from managing and overseeing a broad range of operations during his tenures at Bank of America and Regions Financial.

Micho F. Spring, Age 68

Ms. Spring has served as a director for the Company since 2009 and also serves as a member of NBH Bank’s board of directors. Ms. Spring is Chair, Global Corporate Practice of Weber Shandwick. Prior to joining Weber Shandwick, Ms. Spring was Chief Executive Officer of Boston Telecommunications Company. She served for four years as Deputy Mayor of Boston. She previously served as Chief of Staff to Boston Mayor Kevin H. White after four years of service in New York City government. Ms. Spring also served as a director of Citizens Bank of Massachusetts, one of the largest state-chartered banks in Massachusetts at the time of her service. Ms. Spring currently serves as Vice Chair of the Greater Boston Chamber of Commerce and on a member of the Corporation of Partners Healthcare, Inc. She also serves on numerous boards of civic organizations, including John F. Kennedy Library Foundation, Friends of Caritas Cubana and the Massachusetts Conference for Women. Ms. Spring attended Georgetown and Columbia Universities and received a Masters in Public Administration from Harvard’s Kennedy School of Government. Ms. Spring’s extensive public policy experience, expertise in public relations, involvement in community activities and knowledge of financial institutions make her a valuable member of our Board.

Burney S. Warren, III, Age 70

Mr. Warren has served as a director for the Company since 2009 and also serves as Chairman of the Compensation Committee. Mr. Warren has also served as an advisor to South State Corporation, a bank holding company based in South Carolina, since 2009. Prior to retirement in December 2007, Mr. Warren was Executive Vice President and Director of Mergers and Acquisitions for Branch Banking and Trust Company (“BB&T”), one of the largest commercial banks in the United States. Mr. Warren was responsible for the development, structure and negotiation of BB&T’s bank and non-bank acquisitions. During his tenure, he successfully completed the acquisition of over 50 banks and thrifts and numerous nonbank transactions, including capital markets, brokerage, fixed income and consumer finance. Prior to joining BB&T in 1990, Mr. Warren was President and Chief Executive Officer of First Federal Savings Bank, Greenville, N.C. Mr. Warren serves on the boards of the East Carolina University Foundation and East Carolina University Real Estate Foundation, and is the former chairman of the Real Estate Foundation. Mr. Warren received a Bachelor of Science degree in Business Administration from East Carolina University. Mr. Warren’s qualifications to serve on our Board of Directors include his extensive financial institutions experience, including identifying and integrating acquisitions for complex financial institutions.

7

| |

8 | National Bank Holdings Corporation |

Age: 61 | Robin A. Doyle Independent Director Audit & Risk Committee Member EXPERIENCE AND QUALIFICATIONS Ms. Doyle has served as a director for the Company since March 18, 2024 and serves on the Board’s Audit & Risk Committee. Ms. Doyle owns and operates her own consulting firm focused on strengthening client’s data and risk management capabilities. Ms. Doyle is on the board of Dress for Success Central New Jersey and serves as a member of the executive committee and is chair of the finance committee.She is also a board member and Treasurer of her condominium owners association and serves on the advisory board of the Women’s Data Professional Group of the EDM Council. Ms. Doyle served as a founding board member of the Global Legal Entity Identifier Foundation (GLEIF), where she was chair of the audit and finance committee and vice chair of the governance committee. Ms. Doyle was a founding board member for the Rutgers Business School Center for Women inBusiness, the Rutgers Business School dean’s advisory board, the board of NJ Junior Achievement and the board of Easter Seals of New Jersey where she also founded the organization’s first audit committee. During her 28 year career at J.P. Morgan (NYSE:JPM), Ms. Doyle served in several senior management roles at the company, including managing director in JPM’s Office of Regulatory Affairs, chief financial officer for the firm’s risk management organization, where she was also an executive member of J.P. Morgan’s board of directors risk policy committee, senior vice president of Chase Home Finance and senior vice president of JPM accounting policies group before retiring from JPM in 2021. Prior to joining JPM, Ms. Doyle held roles at Midlantic National Bank (now PNC Bank) in internal audit, KPMG’s audit department, and Prudential Insurance Co. Ms. Doyle has an MBA in Business and BS in Accounting from Rutgers University. Ms. Doyle’s distinguished career and expertise in financial services includes managing a number of finance functions, internal and external audit experiencing and managing a broad range of risk management functions, including risk governance, risk appetite, finance and technology. These experiences qualify her to serve on our Board of Directors. |

| |

2024 Annual Proxy Statement | 9 |

Age: 54 | Alka Gupta Independent Director Audit & Risk Committee Member Compensation Committee Member EXPERIENCE AND QUALIFICATIONS Ms. Gupta has served as a director for the Company since 2021 and serves on the Board’s Audit & Risk Committee and Compensation Committee. Ms. Gupta is a Fortune 500 executive and tech entrepreneur with deep experience in digital transformation. Ms. Gupta currently serves as a director of Dwolla, and as the board chair of Digital Frontiers. From 2021 to 2023, Ms. Gupta was a director of MoneyGram International, Inc., where she also was a member of the Compliance and Ethics Committee. She previously served as a Venture Partner at Fin Venture Capital, a fintech B2B focused global venture fund. She was also Co-Founder and former President and board director at GlobaliD, Inc. During her tenure at GlobaliD, she led GlobaliD's growth, including building a high-quality team, launching a cutting-edge product and signing on first digital wallet customers. Prior to this, she was an executive at eBay/PayPal as Head of Strategy for eBay Marketplaces building new growth strategies in areas such as mobile commerce and cross-border payments. She earned her Master of Business Administration from the University of Pennsylvania Wharton School and her Bachelor of Science degree from Case Western Reserve University. |

| |

10 | National Bank Holdings Corporation |

| Joseph is a past President of the North American Securities Administrators Association (“NASAA”), and also served as a director on NASAA’s Board for almost a decade. Mr. Joseph currently serves as a board member of the Colorado Board of Mortgage Loan Originators, being appointed to that position by the Colorado Governor in 2014, and reappointed in 2018. He also serves as a member of the Investor Issues Committee for the Financial Industry Regulatory Authority (FINRA). In addition, Mr. Joseph serves as an advisory board member for Plains Dedicated, a privately-held trucking company.Mr. Joseph holds a Bachelor of Science degree in Business Administration from Colorado State University-Pueblo and an MBA in Finance and Accounting from Regis University in Denver. Mr. Joseph’s substantial experience in the regulatory fields of financial services and securities qualifies him to serve on our Board of Directors. | |

Age: 71 | Fred J. Joseph Independent Director Audit & Risk Committee Member Nominating & Governance Committee Member EXPERIENCE AND QUALIFICATIONS Mr. Joseph has served as a director for the Company since 2014 and serves on the Board’s Audit & Risk Committee and Nominating and Governance Committee. He is a board member of both NBH Bank and Bank of Jackson Hole Trust. He is also a member of the Trust Committee of Bank of Jackson Hole Trust. Mr. Joseph is currently an advisory board member for Plains Dedicated, a privately-held trucking company. From 2014 to 2022, Mr. Joseph served as a board member of the Colorado Board of Mortgage Loan Originators and previously served as a board member of the Investor Issues committee for the Financial Industry Regulatory Authority (FINRA). Mr. Joseph was a financial services regulator for 30 years, retiring at the end of 2013 as the Banking and Securities Commissioner for the State of Colorado, a dual role created in 2011. From 2008 to 2010, Mr. Joseph served as the Acting Banking Commissioner for the State of Colorado. He was originally appointed as the Securities Commissioner in 1999. In that role, he oversaw the regulatory agency that licenses stockbrokers, brokerage firms and investment advisers in Colorado. In his role as the Banking Commissioner, he had regulatory oversight of state-chartered commercial banks, money transmitters and trust companies in Colorado. From 1992 to 1999, he was the Deputy Securities Commissioner for the State of Colorado. In that position, he oversaw the examination functions as well as the administrative matters for the Colorado Division of Securities. Prior to that, he was the Deputy Commissioner of Financial Services in Colorado for eight years, where he was responsible for the examination and regulatory oversight of state-chartered savings and loan associations and credit unions in Colorado. Mr. Joseph is a past President of the North American Securities Administrators Association (“NASAA”), and also served as a director on NASAA’s board for almost a decade. Mr. Joseph holds a Bachelor of Science degree in Business Administration from Colorado State University-Pueblo and an MBA in Finance and Accounting from Regis University in Denver. Mr. Joseph’s substantial experience in the regulatory fields of financial services and securities qualifies him to serve on our Board of Directors. |

Art Zeile, Age 54

| |

2024 Annual Proxy Statement | 11 |

| ad range of banking operations for more than 35 years. | |

Age: 63 | G. Timothy Laney Chairman of the Board EXPERIENCE AND QUALIFICATIONS Mr. Laney has served as the Company’s President, Chief Executive Officer and director since 2010, and as the Chairman of the Board of Directors since 2014. Mr. Laney currently holds the same positions at NBH Bank, and as the Chairman and Chief Executive Officer of Bank of Jackson Hole Trust, including serving as the Chairman on its Trust Committee. Additionally, Mr. Laney is a board member of Finstro Global Holdings Inc., Finexio, Moffitt Cancer Center, the Chairman of the USA Weightlifting Foundation and is the founder of the NBH Bank Do More Charity Challenge®. Mr. Laney previously served as a board member of the Colorado Bankers Association. Mr. Laney is the former Senior Executive Vice President and Head of Business Services at Regions Financial, one of the nation’s largest full-service banks. In 2007, he joined Regions Financial to lead the transformation of the bank’s wholesale lines of business. Prior to his tenure at Regions Financial, Mr. Laney had a 24-year tenure with Bank of America, where he held senior management roles in small business, commercial banking, private banking, corporate marketing and change management. He also served as President of Bank of America, Florida, with more than 800 banking centers and $50 billion in total assets. He was also a member of Bank of America’s Management Operating committee. Mr. Laney brings to our Board of Directors valuable and extensive experience from managing and overseeing a broad range of banking operations for more than 35 years. | |

| | |

| ||

Age: 66 | Patrick G. Sobers Director EXPERIENCE AND QUALIFICATIONS Mr. Sobers has served as a director for the Company since 2021 and also serves as a member of the board of directors of both NBH Bank and Bank of Jackson Hole Trust. Mr. Sobers previously served as the EVP, Head of Business and Consumer Banking for NBH Bank. Mr. Sobers is currently a member of the board of trustees of Denver Seminary, a member of the Foundation board of the Moffitt Cancer Center, and he is the Treasurer for Third Way Center, as well as a member of its board. He has been very active in the communities where he has resided, serving on the boards of numerous civic and charitable organizations. Mr. Sobers has over 30 years of experience in the financial services industry. Prior to joining NBH Bank in 2012, he held several leadership positions at Bank of America, including: the Southeast Region’s Consumer Banking Executive; Customer Service and Solutions Executive; Premier Banking and Investments Regional Executive for Florida and Georgia (now Merrill Lynch Wealth Management); and as Tampa Market President. He holds a Bachelor of Applied Science degree in Business Administration from Boston University. | |

Mr. Zeile has served as a director for the Company since July 2016. Mr. Zeile is currently the CEO

| |

12 | National Bank Holdings Corporation |

Age: 74 | Micho F. Spring Independent Director Audit & Risk Committee Member Nominating & Governance Committee Member EXPERIENCE AND QUALIFICATIONS Ms. Spring has served as a director for the Company since 2009 and serves on the Board’s Audit & Risk Committee and Nominating and Governance Committee. She also serves as a member of the board of directors of both NBH Bank and Bank of Jackson Hole Trust. Ms. Spring is currently a senior advisor at Weber Shandwick. Ms. Spring also currently serves as Chair Emeritus and is on the Executive Committee of the Greater Boston Chamber of Commerce and is a member of the Corporation of Partners Healthcare, Inc. She also serves on numerous boards of civic organizations, including National Association of Corporate Directors (NACD) New England, John F. Kennedy Library Foundation, Friends of Caritas Cubana and the Massachusetts Conference for Women. From 1992 to 2022, she was a senior executive at Weber Shandwick, where she served as Chief Reputation Officer, Chair of the Global Corporate Practice and President of New England. Prior to joining Weber Shandwick, Ms. Spring was Chief Executive Officer of Boston Telecommunications Company. Ms. Spring served for four years as Deputy Mayor of Boston. She previously served as Chief of Staff to Boston Mayor Kevin H. White after four years of service in New York City government. She also served as a director of Citizens Bank of Massachusetts, one of the largest state-chartered banks in Massachusetts at the time of her service. Ms. Spring attended Georgetown and Columbia Universities and received a Masters in Public Administration from Harvard’s Kennedy School of Government. Ms. Spring’s extensive public policy experience, expertise in public relations, involvement in community activities and knowledge of financial institutions make her a valuable member of our Board. | |

| | |

| | |

Age: 60 | Art Zeile Independent Director Compensation Committee Chair Audit & Risk Committee Member EXPERIENCE AND QUALIFICATIONS Mr. Zeile has served as a director for the Company since 2016 and also serves as Chairman of the Compensation Committee and as a member of the Audit & Risk Committee. Mr. Zeile is currently the CEO of DHI Group, Inc. (NYSE: DHX), a leading provider of data, insights and employment connections through its specialized services for technology professionals and other select online communities. Mr. Zeile currently serves on the board of his own company, DHI Group, Inc., and also serves as an advisor of the Dispatch Health Advisory board. From 2008 to 2016, Mr. Zeile co-founded and served as the CEO of HOSTING, a pioneer in the cloud hosting space. From 2004 to 2006, he served as a director for Intrado (NASDAQ: TRDO) and served on the Audit Committee. During that time he was also a director of several other private companies. His extensive career experience also includes serving as CEO and co-founder of several technology companies. He began his career as an officer in the U.S. Air Force. Mr. Zeile holds a Master of Public Policy from the JFK School of Government, Harvard University and a Bachelor of Science in Astronautical Engineering from the U.S. Air Force Academy. Mr. Zeile's extensive experience in software, telecommunications, internet, datacenter and security technologies, with a particular focus on cybersecurity, qualifies him to serve on our Board of Directors. |

| |

2024 Annual Proxy Statement | 13 |

Governance

The Board is committed to sound and effective governance principles and practices. The Board has adopted Governance Guidelines to provide the framework for the governance of the Board and the Company. These Guidelinesguidelines set forth, among other matters, qualifications for Board membership, director independence standards, director responsibilities, information about the structure of the Board and its committees, director compensation, management succession and Board self-evaluation. Each director serves for a one-year term. We do not have a staggered or classified board.Board.

The Board has adopted a Code of Business Conduct and Ethics that applies to all of our associates includingas well as our directors. Additionally, the Board has adopted a Supplemental Code of Ethics for CEO and Senior Financial Officers (together, with the Code of Business Conduct and Ethics, the “Codes of Ethics”). We expect all of our associates to adhere to the highest standards of ethics and business conduct with other associates, clients, shareholders, and the communities we serve and to comply with all laws, rules, and regulations that govern our business.

Shareholders and other interested persons may view our Governance Guidelines, our Codes of Ethics and other key information about our corporate governance on our website at www.nationalbankholdings.com.

Board and Committee Meetings; Annual Meeting Attendance

Directors are expected to attend all Board meetings and meetings of committeescommittees. Only committee members vote on which they serve.committee actions taken.

The Board held eight7 meetings during 2017. During 2017,2023 and each director attended at least 75% of the total number of meetings of the Board and committees on which he or she served.committees. The Board and each standing committee regularly meet in executive session. During 2017,2023, the Board met in executive sessions without the CEO and other members of management fivepresent four times. During 2017,2023, the independent Lead Director chaired each of the executive sessions of the Board, and the chairs of each committee chaired the executive sessions of the committees.

All directors are expected to attend each annual meeting of shareholders of the Company. In 2017,2023, all directors attended the Company’s annual meeting of shareholders.

The Board has established three standing committees: Audit and& Risk Committee, Compensation Committee and Nominating and& Governance Committee. The Board’s committees act on behalf of the Board and report on their activities to the entire Board. The Board appoints the members and chair of each committee based on the recommendation of the Nominating and& Governance Committee. In 2023, the Audit & Risk Committee appointed a sub-committee to oversee Emerging Technologies and reports to the Audit & Risk Committee.

8

| |

14 | National Bank Holdings Corporation |

The following table provides membership information for each of the Board’s standing committees as of the date of this proxy statement.

Audit & Risk Committee | Compensation Committee | Nominating & Governance Committee | |||||

|

|

| |||||

Ralph W. Clermont, Chair* | | Art Zeile, Chair |

| | Robert E. Dean, Chair | | |

Robert E. Dean | | Ralph W. Clermont | | Ralph W. Clermont | | ||

Robin A. Doyle | | Robert E. Dean | | Fred J. Joseph | | ||

Alka Gupta* | | Alka Gupta | | Micho F. Spring | | ||

Fred J. Joseph | |

| |

| | ||

Micho F. Spring | |

|

| ||||

| | ||||||

Art | | | | | |

*Member of the Emerging Technologies Sub-Committee (Art Zeile, Chair)

With respect to each committee, the Board has adopted a charter that addresses its purpose, authority and responsibilities and contains other provisions relating to, among other matters, membership and meetings. In its discretion, each committee may form and delegate all or a portion of its authority to subcommittees of one or more of its members. As required by its charter, each committee periodically reviews and assesses its charter’s adequacy and reviews its performance, and also is responsible for overseeing risk related to the responsibilities described in its charter. Shareholders and other interested persons may view each committee’s charter on the Investor Relations section of our website at www.nationalbankholdings.com.

Audit and& Risk Committee

Purpose and Responsibilities. The Audit and& Risk Committee is responsible for, among other things:

| ● |

| reviewing our financial statements and public filings that contain financial statements, significant accounting policy changes, material weaknesses and significant deficiencies, if any, and risk management issues; |

| ● |

| overseeing the performance of our internal audit function as well as serving as an independent and objective body to monitor and assess our compliance with legal and regulatory requirements, our financial reporting processes and related internal control |

| ● | reviewing the |

| ● |

| overseeing the audit and other services of our outside auditors and being directly responsible for the appointment, independence, qualifications, compensation and oversight of the outside |

| ● |

| discussing any disagreements between our management and the outside auditors regarding our financial |

| ● |

|

| ● | preparing the Audit |

Membership and Meetings. Under its charter, the Audit and& Risk Committee must have a minimum of three members. No Audit and& Risk Committee member may serve on the audit committee of more than two other public companies. Each member of the Audit and& Risk Committee is independent, as independence for audit committee members is defined by NYSE and SEC rules, as discussed below under “Director Independence.” The Board has determined, in its business judgment, that each current member of the Audit and& Risk Committee is financially literate as required by NYSE rules, and that Mr. Clermont, the committee’s chair, qualifiesand Ms. Doyle, each qualify as an “audit committee financial expert” as defined by SEC regulations.

The Audit and& Risk Committee meets as often as necessary to carry out its responsibilities, but no less than quarterly. In 2017,2023, the Audit and& Risk Committee met four times.

| |

2024 Annual Proxy Statement | 15 |

Compensation Committee

Purpose and Responsibilities. The Compensation Committee is responsible for, among other things:

| ● |

| determining the compensation of our executive officers; |

| ● |

| reviewing our executive compensation policies and plans; |

| ● |

| oversight of the Company’s compensation practices generally; |

| ● |

| administering and implementing our equity compensation plans; |

| ● |

| preparing a report on executive compensation for inclusion in our proxy statement for our annual meeting; and |

| ● |

| overseeing the Company’s talent management and succession planning process, including succession planning for the position of CEO. |

9

The Compensation Committee’s process and procedures for establishing compensation for our Named Executive Officers is discussed in the “Compensation Discussion and Analysis” section elsewhere in this proxy statement.

Membership and Meetings. Under its charter, the Compensation Committee must have a minimum of three members, two of which must meet the definition of a “non-employee director” under Rule 16b-3 of the Securities Exchange Act of 1934 (the “Exchange Act”) and qualify as an “outside director” under Internal Revenue Code Section 162(m). All Compensation Committee members must be independent under NYSE rules. The Board has determined that each current Compensation Committee member meets these qualifications, as further discussed below under “Director Independence.” The Compensation Committee meets as often as necessary to carry out its responsibilities.responsibilities, but no less than quarterly. In 2017,2023, the Compensation Committee met four times.

Nominating and& Governance Committee

Purpose and Responsibilities. The Nominating and& Governance Committee is responsible for, among other things:

| ● |

| identifying individuals qualified to become members of our Board of Directors and recommending director candidates for election or reelection to our Board; |

| ● |

| reviewing and making recommendations to our Board of Directors with respect to the compensation and benefits of directors; |

| ● |

| reviewing and approving or ratifying all related-party transactions in accordance with the Company’s Related Person Transactions Policy; |

| ● |

| assessing the performance of our Board of Directors and its committees; and |

| ● |

| monitoring our governance policies, principles and |

Information about the Nominating and& Governance Committee’s process and procedures for establishing director compensation appears below under the “Director Compensation” section.

Membership and Meetings. Under its charter, the Nominating and& Governance Committee must have a minimum of three members, each of whom must be independent under NYSE rules. The Board has determined that each member meets this standard, as discussed below under “Director Independence.” The Nominating and& Governance Committee meets as often as necessary to carry out its responsibilities.responsibilities, but no less than quarterly. In 2017,2023, the Nominating and& Governance Committee met four times.

Our Governance Guidelines and committee charters require that a majority of the members of the Board of Directors and all members of the Audit and Risk Committee, the Compensation Committee and the Nominating and Governance Committee meet the criteria for independence required by the NYSE. Our Governance Guidelines require all members of the Audit and Risk Committee to meet the heightened independence requirements for audit committee members under the Exchange Act.

In February 2018, the Board, with the assistance of the Nominating and Governance Committee, undertook its annual review of director independence. In connection with this review, the Board evaluated banking, commercial, business, investment, legal, charitable, consulting, familial or other relationships with each director, and us and our affiliates. As a result of this review, the Board affirmatively determined that all of the directors are independent of the Company and its management under the corporate governance standards of the NYSE, including applicable SEC rules, with the exception of G. Timothy Laney because of his employment as an executive of the Company.

The Board is responsible for overseeing the exercise of corporate power and seeing that our business and affairs are managed to meet our stated goals and objectives and that the long-term interests of our shareholders are served. The Company currently does not have a fixed policy with respect to whether the same person may serve as both the Chairman of the Board and the Chief Executive Officer. The Board believes that it is in the best interests of the Company for the Board, in consultation with the Nominating and Governance Committee, to make this determination from time to time. Pursuant to the Company’s Governance Guidelines, when the position of Chairman of the Board is

10

not held by an independent director, the independent directors shall appoint an independent director to serve as the independent Lead Director.

In 2014, the Board elected G. Timothy Laney, President and Chief Executive Officer of the Company, to serve as Chairman of the Board and the independent directors appointed Ralph W. Clermont to serve as the independent Lead Director. The Board has concluded, based upon the Company’s size and history and its years of experience with Mr. Laney as Chief Executive Officer and as a fellow director, that a combined Chairman/CEO role for Mr. Laney and an independent Lead Director with a strong role and defined authorities is the better corporate governance structure for the Company at this point in its history. The Board considered Mr. Laney’s strong leadership roles with the Company’s shareholders and other stakeholders and with ongoing strategic planning, among other factors, and Mr. Clermont’s demonstrated ability to work with the Company’s senior management and provide leadership on Board and committee issues. The Board has been very pleased with its four years of experience under this board leadership structure, which has enhanced Board communication and strategic planning.

The Board believes that the duties of the independent Lead Director under the Company’s Governance Guidelines and the Board’s practice of regular meetings of, and communications between, independent directors in executive session without management both are important parts of the Company’s corporate governance safeguards. Pursuant to the Company’s Governance Guidelines, the duties of the independent Lead Director include: (i) serving as a liaison, and facilitating communication, between the Chairman of the Board and the independent directors; (ii) organizing, convening and presiding over executive sessions of the independent directors; (iii) presiding at all meetings of the Board at which the Chairman of the Board is not present; (iv) approving meeting schedules and agendas proposed by the Chairman and Chief Executive Officer, and consulting with the Chairman and Chief Executive Officer regarding the information to be provided to the directors in conjunction with such meetings; (v) serving as an advisor to the Board committees, chairs of the Board committees and other directors; (vi) serving as a member ex officio of each of the Board’s standing committees, with full voting rights on each such committee; (vii) if requested by major shareholders, ensure that he or she is available for consultation and direct communication; (viii) call meetings of the Board if deemed advisable by the independent Lead Director; and (ix) such other duties and responsibilities as assigned from time-to-time by the independent directors. As part of his duties as Lead Director, Mr. Clermont speaks regularly with Mr. Laney throughout the year.

Our current board leadership structure supports the independence of the independent directors. The independent directors meet in executive session at each Board meeting and each of the standing committees is comprised solely of and led by independent directors. Our independent Lead Director presides at each executive session of the independent directors of the Board and the independent committee chairs preside over the executive sessions of their respective committees. Moreover, both the Chairman and the independent Lead Director serve as members of the board of directors of the Company’s wholly-owned subsidiary, NBH Bank (the “Bank Board”), which further contributes to the oversight of our business, management and policies.

The Board’s Role in Risk Oversight

Our Board of Directors oversees risk management throughout the Company. The Board accomplishes this primarily through its three standing committees, each of which is active in risk management.

The Audit and Risk Committee is responsible for oversight of the Company’s market, credit, liquidity, fraud, legal, compliance and other financial, operational (including cybersecurity) and reputational risks. The Audit and Risk Committee is further responsible for reviewing and approving guidelines, policies and processes for managing these risks. The Audit and Risk Committee monitors the Company’s risk exposure in all risk categories through regular reports prepared by members of management, including the Company’s Chief Risk Management Officer. The Audit and Risk Committee determines the risk appetite of the Company. Additionally, the Audit and Risk Committee meets with representatives from the Company’s internal audit function and the Company’s independent registered public accountant, including in executive sessions without management present.

The Compensation Committee oversees risks related to compensation, including risks that may arise from the Company’s incentive compensation practices. The Compensation Committee oversees and evaluates the design, administration and risk management of all of the Company’s material incentive compensation arrangements to ensure consistency with the safety and soundness of the Company and to appropriately balance risk and reward. The

11

Compensation Committee also oversees the annual compensation risk assessment to identify any compensation practices that may present an unacceptable level of risk to the Company.

The Nominating and Governance Committee oversees the Company’s governance program. This includes the Company’s Code of Ethics, Insider Trading Policy, disclosure policies, management of potential conflicts of interest, including related party transactions, and director independence.

Shareholders and other interested parties who wish to communicate with the Board, the independent directors as a group, or one or more individual directors may do so by contacting the Board’s Secretary by mail at National Bank Holdings Corporation, 7800 E. Orchard Road, Suite 300, Greenwood Village, CO 80111. Under our Governance Guidelines, the Secretary is responsible for referring such communication to the Board.

Director Nomination Process, Director Qualifications and Board Diversity

Director Selection Process and Qualifications.The Nominating and& Governance Committee is responsible for identifying and reviewing the qualifications and skills of Board candidates and for recommending candidates for membership on our Board of Directors. The NominatingBoard has continually sought directors with backgrounds and Governance Committee is responsible for identifyingskills important to the priorities of the Company, which continue to change in connection with our strategic

| |

16 | National Bank Holdings Corporation |

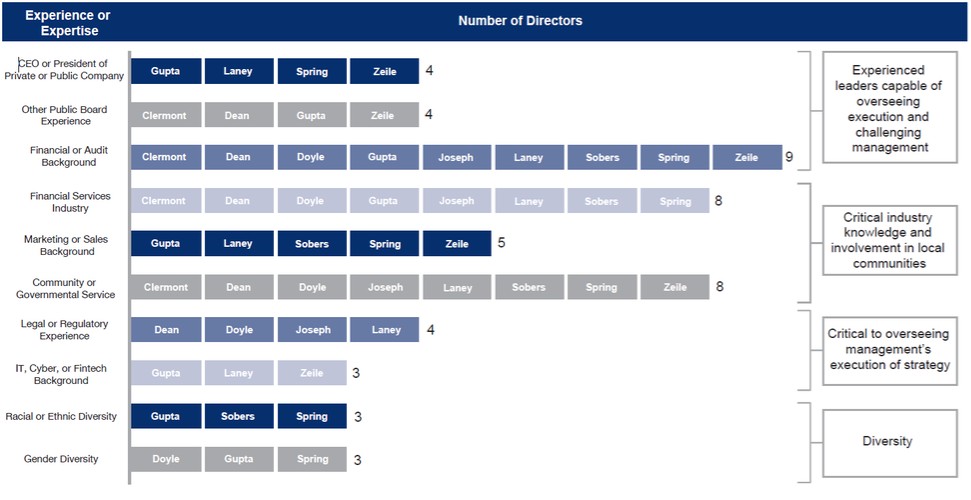

objectives, including our digital strategy. Significant banking regulatory skills were added when Mr. Joseph joined our Board in 2014. In 2016, high-level technology and reviewingcybersecurity skills were added with the qualificationsappointment of Mr. Zeile as a director. The 2021 additions of Ms. Gupta and independence of Board candidates. While the Nominating and Governance Committee doesMr. Sobers not have a formal policy regardingonly added diversity pursuant to our Governance Guidelines,Board, but Ms. Gupta brings a breadth of digital payments skills and Mr. Sobers brings his significant years of consumer banking experience, both of which reflect the continual evolution of our Board. The 2024 addition of Ms. Doyle brings significant experience in accounting, risk management and regulatory affairs, and Ms. Doyle qualifies as an “audit committee financial expert” as defined by SEC regulations. The breadth of experience and skills of the proposed Board is exemplified by the Board Skills Matrix chart below:

Director Diversity and Director Appointments. The Nominating and& Governance Committee considers diversity in its assessment of potential nominees for Board membership. The amount of consideration givenmembership, pursuant to diversity variesour Governance Guidelines. Since mid-2021, we have added three new diverse Board members with important experience and skillsets, as discussed above. These have included Patrick Sobers (August 2021), Alka Gupta (November 2021) and Robin Doyle (March 2024). Combined with the Nominatingretirement of Burney Warren, a director since 2009, these additions have significantly increased our board diversity and Governance Committee’s determination of whether we would benefit from expandingreduced the Board’s diversity in a particular area. We believe that the compositionaverage age and tenure of our Board has consistently demonstrated diversity as defined by viewpoint, background and professional experience, which is further exemplified by the chart below:directors.

Director Qualifications

|

|

|

|

|

|

| |

|

| ||||||

|

|

|

|

|

|

| |

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

|

| ||||

|

|

|

|

| |||

|

|

|

|

Recent NBHC Director Appointments. In early 2016, the Nominating and Governance Committee began reviewing potential candidates for the Board given Frank Cahouet’s expected retirement from the Board in May 2016. The full Board (including Mr. Cahouet) gave input to the Committee regarding desired skills and other attributes of future additions to the Board and provided potential candidate names throughout the process. Since the Board added significant banking and securities regulatory expertise in 2014 with the addition of Fred Joseph to the Board, in 2016 it decided to

12

seek candidates with significant information technology expertise, particularly in the area of cybersecurity, given the importance of that area to the business of the Company. The Board also prioritized its search for 1) female candidates, 2) candidates in the Company’s primary geographic areas of the Kansas City Metro Area and Colorado and 3) candidates with prior public company board experience. An extensive review of candidates who would add to the diversity of the existing Board both, in terms of skills and gender, was undertaken. Given the primary goal of adding information technology and cybersecurity skills to the Board and in light of the ages of the other independent board members (then 63-68 years of age), there was also a focus on relatively younger candidates during the search process.

In June 2016, after an extensive search for and evaluation of the candidates, the Nominating and Governance Committee recommended that Art Zeile be appointed to the Board based on his experience and background, including his extensive information technology and cybersecurity expertise. Mr. Zeile was approved by the full Board and joined as an independent director on July 1, 2016.

The Nominating and Governance Committee is not currently looking to expand the size of its Board, but the committee expects to place a high priority on seeking a female candidate in the event that a new director appointment is considered.

Diversity and Inclusion at NBH Bank. From our independent directors to our front line associates, we believe diversity and inclusion are important elements in building and sustaining a successful organization and a positive, results-driven culture. In addition to our focus on diversity and inclusion with respect to our Company Board, we have extended that focus to our Bank Board, which is diverse in experience and both racial and gender diversity. For additional information regarding our Bank Board, please visit www.nationalbankholdings.com. It is also an important goal of the Company to have diverse management that is reflective of our community, clients and associate base. Finally, our commitment to diversity and inclusion is further evidenced by the Company-wide program we developed to tangibly foster equality and leadership development opportunities for our entire associate base. This extends to our involvement in civic and community organizations and activities that help us actively demonstrate advocacy for equality in the markets we serve.

Shareholder Nominations. Shareholders are welcome to recommend candidates for membership on the Board. The Nominating and& Governance Committee, in accordance with its charter, will evaluate candidates in the same manner that it evaluates other potential nominees. Our Bylaws require timely notice of shareholder nominations to our Secretary, as further discussed in the section “2019“2025 Annual Meeting of Shareholders - Shareholder Proposals” elsewhere in this proxy statement. In order to make a nomination, a shareholder must be a shareholder at the time the Company gives notice of its annual meeting and at the time of the annual meeting, must be entitled to vote at the annual meeting, and must comply with the procedures of our Bylaws. The Bylaws require certain information regarding shareholders who wish to nominate candidates for Board membership. This includes (i) the name and address of such shareholder, as they appear on the Company’s books, of such beneficial owner, if any, and of their respective affiliates or associates or others acting in concert therewith, (collectively, the “Nominating Party”), (ii) information regarding the shares owned by the Nominating Party, (iii) information regarding derivative and other instruments regarding the Company’s stock that the Nominating Party owns, (iv) contracts, arrangements, understandings or relationships the Nominating Party has entered into concerning the Company’s stock and (v) other information relating to the Nominating Party that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for the election of directors in a contested election pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder. For complete description of the requirements and procedures for shareholder nominations, please refer to our Bylaws.

| |

2024 Annual Proxy Statement | 17 |

Compensation Committee Interlocks and Insider Participation

During 2017,2023, Messrs. Warren,Zeile, Clermont, Dean and Warren and Ms. SpringGupta served as members of our Compensation Committee. Mr. Warren did not stand for re-election and retired on May 9, 2023. None of them has at any time been an officer or associate of the Company, and none has had any relationship with the Company of the type that is required to be disclosed under Item 404 of Regulation S-K. None of our executive officers serves or has served as a member of the boardBoard of directors, compensation committeeDirectors, Compensation Committee or other board committee performing equivalent functions of another entity that has one or more executive officers serving as a member of our Board of Directors or Compensation Committee.

Director Independence

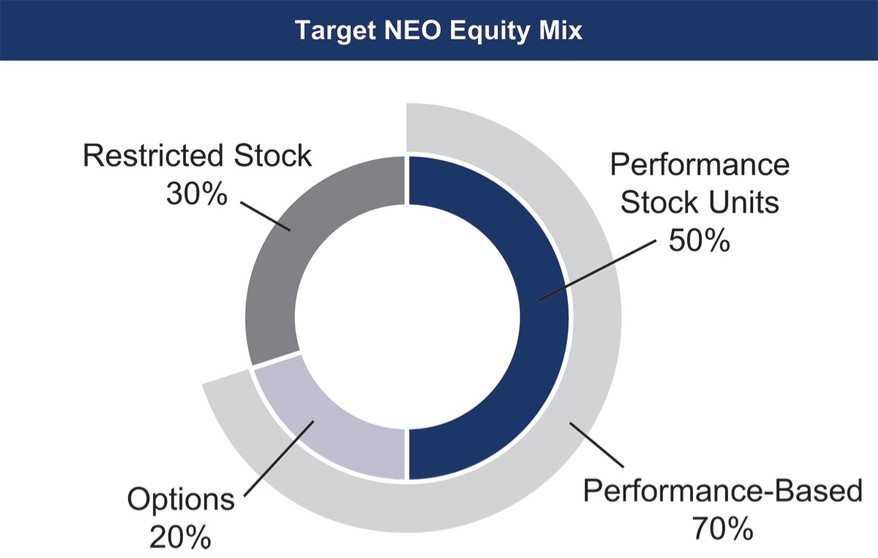

Our Governance Guidelines and committee charters require that a majority of the members of the Board of Directors and all members of the Audit & Risk Committee, the Compensation Committee and the Nominating & Governance Committee meet the criteria for independence required by the NYSE. Our Governance Guidelines require all members of the Audit & Risk Committee to meet the heightened independence requirements for audit committee members under the Exchange Act.